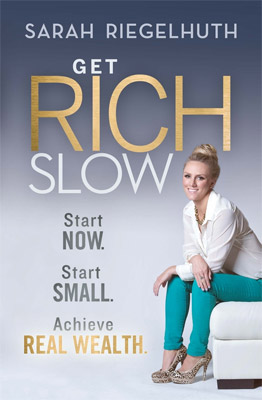

Get Rich Slow

Get Rich Slow

How to build wealth the smart way-slow and steady!

This book will show you how to take control of your finances and grow your wealth using nothing more than a few key principles and common-sense wisdom. It shows you how to let go of easy excuses, stop waiting around for magically simple solutions, set intelligent financial goals, and design an action plan that you can follow through to completion. Using a storytelling approach, it shares the financial experiences of the author and her clients, guiding readers through the tools and tactics necessary to effect positive financial change in their lives. Although focused on personal finance goals, the lessons here easily translate to life itself.

Sarah Riegelhuthis a senior financial adviser and co-founder of award-winning boutique financial advisory firm Wealth Enhancers. In 2011 Sarah co-launched the League of Extraordinary Women, an organisation supporting and developing young female entrepreneurs.

Get Rich Slow: Start Now, Start Small to Achieve Real Wealth

Wiley

Author: Sarah Riegelhuth

ISBN: 9781118406168

Price: $29.95

Interview with Sarah Riegelhuth

Question: What is the idea behind Get Rich Slow?

Sarah Riegelhuth: The idea behind the book Get Rich Slow was born out of the GFC and the way people are feeling in regards to world creation; they're not looking to get rich quick as they know it doesn't really work and it's not sustainable. I saw this trend and I wanted to create a book where I could talk through the real way to create wealth which is starting small but starting; a lot of people put things off whether that is for when they have more time or money but what you really need to do is actually start now even if it is small because the earlier you start the more likelihood you'll have of wealth in the long-term.

Get Rich Slow is about sustainable world creation, chipping away to be able to create the life that you want for yourself.

Question: Why is it smarter to get rich slowly?

Sarah Riegelhuth: We all want to get rich quickly (of course) but it's not really possible as most of the methods don't work. It's a lot smarter to chip away little by little and form good habits and behaviours with money because even if you do come into wealth very quickly, if you don't have good behaviours and habits towards your money the chances are that you won't be able to get that wealth to stick around. If you can form really good behaviours with your spending, saving and investing now then you'll have that with you for the rest of your life.

Question: Can you provide examples of intelligent financial goals?

Sarah Riegelhuth: I believe, and I talk a lot about this in the book, that you need to know what you want for your life such as knowing what you're passionate about and what your purpose is and I know that is hard because you don't always know exactly but at least if you know what you like, in your life, then you can start building goals around that. When I say create intelligent financial goals I refer to creating goals that are about your lifestyle and working back from there to work out how much money you will need to do that. Intelligent financial goals are not saying "I want to have more money" or "I want to have a 100,000 share portfolio" or "I want to have five properties" because that is not giving you anything tangible that you want in your life, it is too monetary. Examples of intelligent financial goals could be wanting to spend two months overseas, each year, because you are passionate about travelling and you need x amount of money to do that; or if you are really passionate about doing something your goal may be to create that and you may need a certain amount of money to do that in x amount of years; or you may want to retire at 55 or 60 years of age and you will need to do x to be able to achieve that.

The way to set goals is about what you actually want in your life not the monetary figure as we naturally opt to setting a target that is purely financial but we need to begin with the 'why'; such as "what is it that we want to achieve in our life" and then we can work out how much we need to be able to do that and go back from there.

It is hard to think long-term when you're younger but we have to look at retirement even though most people don't want to think about it, even if we call it 'financial independence' we are all working towards a point where we are financial independence and we don't need to work anymore. I am 31 years of age and typically our generation starts working a lot later due to the time we finish University and often we haven't started really working until we are 23 or 24 years old and then we think we are going to retire at 50 or 55 when our life expectancy is very long. If you look at our grandparents generation they started working at about 15 years old and retired at 60 or 65 years of age and their life expectancy was 70-75 years of age - they worked a long time to have financial independence for only five to ten years; obviously some are now living longer but their life expectancy is lower. We think we can work for 30 years and then retire for 50 and it just doesn't add up if we don't start straight away. If we do want to have financial independence sooner we have to start building wealth sooner, as well.

Question: Who did you write Get Rich Slow for?

Sarah Riegelhuth: Get Rich Slow is mainly targeted at those between 20 and 40 year old. I believe everyone would be able to get something out of Get Rich Slow but I think in particular it is targeted towards younger people. Those in their 20's that read Get Rich Slow will get a lot out of it including starting building wealth now.

Question: What research did you do for Get Rich Slow?

Sarah Riegelhuth: I did do some research for the book such as crosschecking but 70% of the book is things that I have learnt along the way through formal study, experience and the research I have done, over the years, when working with different clients and a lot of that culminated to that point then I would research further on things that I had a gut feeling on but needed to confirm by researching studies. A lot of the book has come from my experience and education.

Question: What is the League of Extraordinary Women?

Sarah Riegelhuth: We created the League of Extraordinary Women at the end of 2011. I had been attending a lot of entrepreneurial events which were overwhelmingly male dominated; I'd met a couple of really great girls who are my co-founders (Sheryl Thai, Liz Atkinson and Marie Cruz-de Vera) of the League of Extraordinary Women. The four of us would catch-up for coffee and talk about our business and it was great to have other younger women around who were running their own businesses and we could talk about the different challenges and successes. One day we were having coffee and we thought 'imagine if we could create an event, just for women, with a speaker' because there must be other women out there, like us. We thought we'd have 20-30 women attend; when we announced the Melbourne event we sold 160 tickets in three weeks. We ran the event and we got great feedback to keep running events and we launched in Sydney four or five months later and in Brisbane nine or ten months later and we're about to launch in Perth in May, 2013. The League of Extraordinary Women is growing on its own because an entrepreneurial group for younger females was needed in Australia. It wasn't originally our intention to create, what we have, but we want to keep pushing it because we know there are young women out there who are running their own businesses and want to be around other entrepreneurs to share their talent, successes and learn from each other as well as other successful female business owners because we always have female business owners as the main speakers at the events.

Interview by Brooke Hunter

MORE