Why Pledge for Parity: Australia's $100 Billion Opportunity

Why Pledge for Parity: Australia's $100 Billion Opportunity

Westpac research released reveals Australia has a gender earnings gap of $123.4 billion a year; demonstrating why accelerating gender parity is an economic imperative.

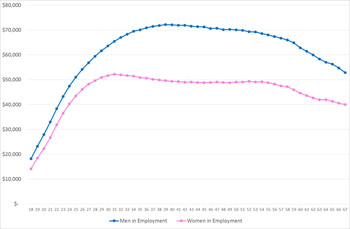

The Westpac International Women's Day Report, designed to explore the 2016 International Women's Day theme Pledge for Parity, revealed women are commencing their fulltime careers earning 11.9 per cent less than men, and are continuing to earn less at every year from then on. It also found on average a woman's salary peaks at 31 years old, where a man's salary reaches its highest point at 39.

A contributing factor to the earnings gap is women have a lower rate of employment than men; with only 63 per cent of women 18-67 in employment, compared to 74 per cent of men. If women achieved the same rate of employment as men, there would be an additional 740,282 additional women in work.

Ainslie van Onselen, Westpac Director of Women's Markets, Inclusion and Diversity said, 'Its clear women face challenges right across their working life. We need to take every opportunity to have a consistent dialogue with business leaders, government, community and our families about the role we all need to play to bridge this gap. We've got the numbers; we see the opportunity, now let's start to accelerate the outcome".

Career breaks were also identified as having a significant impact on the earnings gap and long term earnings potential, with the average woman's salary dropping 3 per cent after a career break and the majority working 17 per cent fewer hours a week on their return to work. Additionally, women are more likely to take maternity leave than men are to take paternity leave; which reduces earnings by an average of 12 per cent.

'Mobilising women to their full potential in the workplace will not only help achieve gender parity but would provide a massive boost to the wider economy, impacting measures such as economic growth, investment, savings and national wealth," Ainslie said.

'The key is to give women choice; whether that's working flexible hours or having two days a week working from home. It's about enabling a full life balance and empowering women to continue on their chosen career path. By introducing professional and personal support – such as education, training, agile work conditions and mentoring – we have helped 93 per cent of our employees return to Westpac after a career break and we have a workforce that is ultimately happier and more productive in their roles.

'We've also introduced pathways opportunities to help women reach senior management positions. Through hardwiring inclusion into the Westpac culture and providing greater support for female leaders, we're on track to meet our target of 50 per cent female leaders in 2017," Ainslie added.

When looking at ways to narrow the parity gap, the research identified that women who take a career break for educational purposes on average increase their salary by 18 per cent.

Asking for a pay rise was also identified as a key contributor, with 60 per cent of women never asking for an increase, compared to only 46 per cent of men. The Westpac International Women's Day Report revealed men are also inclined to ask for larger pay raises, on average $1,816.83 more, however women are more likely to get the full amount requested when they ask.

Ainslie van Onselen's top tips for women when it comes to money and career:

1. Share the load: Sharing the primary care-giver role with your partner can allow you to return to work sooner and continue to progress your career. Make the right decision for you and your family; in some cases it may make more sense for your partner to be the primary care giver.

2. Plan for a career break. Career breaks can be a great time to work out your next move, invest in education or start a family. Plan them in advance and budget accordingly and honestly. For a budget to work you need to be honest with yourself and to look at all money going in and out. Westpac's Online Budget Planner can help you get started. Then set aside a couple of minutes each day to think about your finances, check in on your spending to identify any red flags and how you are tracking.

3. It can't hurt to ask: At your next performance review, or meeting with your manager, why not start salary negotiations or a discussion about what opportunities there are for a pay increase. Arming yourself with evidence, particularly measurable figures will help support your case.

4. Let the young you, look after the old you: The superannuation gap for women is significant, so get organised early and set yourself up. Making additional contributions to your superannuation will help bolster your account and could make a huge difference when it comes to retirement.

MORE