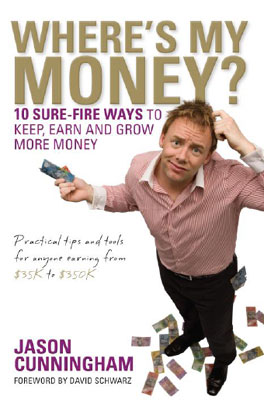

Where's My Money?

Where's My Money?

Are you one of many hard-working Australians living payday to payday? Do you open your wallet at the end of the week and ask "Where's my money gone?"Where's My Money? author Jason Cunningham offers practical techniques to turn around negative financial situations, backed up by real-world examples from his successful accounting practice. He is an engaging speaker and is available for interview on debt recovery and investing topics.

Don't feel bad for wanting a little extra - you work hard for it, and you should have something to show for your effort. The good news is, you can have money and still have a life - the two aren't mutually exclusive. In Where's My Money? author Jason Cunningham covers a range of topics, from basic financial concepts to his own philosophies through to fairly complex investment strategies. This 10-step, plain-English guide has something for everyone - whether you earn $35K or $350K.

Packed with practical tools and real-life examples, Where's My Money? will help you to take charge of your financial future and make your dreams a reality.Discover how to: earn more money - and keep more of it grow money by investing in property and shares master mortgages and own two properties outright before retirement use a business to fast-track financial goals protect assets and reduce tax commitments.

Whether you're struggling under the weight of a mountain of debt or wanting to speed up your financial success, Where's My Money? is the book for you!

Topics Jason can cover include:

· How to turn get out of debt - fast - no matter what income

· How anyone can own two properties outright before retirement

· How to grow money by investing in property and shares

· How to reduce tax commitments

· How to protect your assets in times of financial misfortune

· How to cut the family budget without cutting out the finer things in life

· His own 10 step guide to financial freedom

Interview with Jason Cunningham

How can we tighten our family budgets, during these tough times, without cutting out to many luxuries?Jason Cunningham: Focus on needs not wants, I know I might sound like a bit of a disciplinarian, but in times like this the phrase save for a rainy day is pretty pertinent right about now. We live in a "I want it now" society as opposed to our parents, who in situations when they couldn't afford things, opted for a little thing called lay-by. They had a bit more patience than us and when they couldn't afford something, they'd put a deposit down on the item and repay whatever they could each week until they had paid it off. That's a vast contrast to today where you can "drive away with no more to pay" or buy a plasma, lounge suite, fridge... all 36 months interest free... or is it?

What are your tips to get out of debt, regardless of an individual's income, whether it is credit card or otherwise?

Jason Cunningham: First and foremost, the big concern I have about our modern-day money mindset is our attitude to credit. It's never been easier to get money. Buying a house on credit is one thing, as we are (usually) purchasing an asset that will appreciate in value. But our credit reliance extends to smaller purchases. And as I mentioned above we can easily buy furniture, whitegoods, electrical items - whatever we want - on up to 48 months interest free… Eliminate credit card debt (and short term finance) immediately - the cost is often three times that of a home loan, so if you have a home loan with available equity it might be a good idea to refinance and consolidate that bad debt into home loan. Second of all using credit to purchase luxury items is a big no-no in my books, why go into debt for something that's going to decrease in value?

What are your most successful guidelines in regards to saving?

Jason Cunningham: Without doubt the more we earn the more we spend - therefore if you are looking to save money then the first step is to take it off yourself and put it in a separate bank account… If you don't have it you can't spend it. I'm a firm believer that we should be saving at least 20% of our income, so using the example of the average Australian earning $1,000 per week - $200 per week should be direct debited into a separate account. Rather than living off $1,000 each week, you'll find a way to live off $800, and in the interim you'll be saving in excess of $10,000 a year.

How can we protect our possessions during tough economic times?

Jason Cunningham:Asset protection is becoming more and more relevant as we become more like the US each day. Law suits are more prevalent as society's attitude is changing to a blame culture... it's someone else's fault for their own misfortune. It's therefore important that you're protected, particularly for those who are susceptible to litigation - like those of us in business. Don't own anything your own name, the smart business owners own their investments in companies and trusts that are separate from their businesses.

What can a family do to pay off their mortgage sooner?

Jason Cunningham: In Chapter 8, Beating the banks - strategies for mastering your home loan, I discuss 9 ways to beat the banks... and none which involve wearing a balaclava. Some of these strategies include:

How do you suggest parents teach saving and money management to their children?

Jason Cunningham: As parents, we all want a better life for our kids… better than the one we had, so we do our best to give them everything however inadvertently we are doing them an injustice. I am a firm believer that kids need to learn the value of money, and to not take it for granted. I had my first job at 13, selling records at the footy, and I turned out ok. I remember having to save up to buy my own runners 'cause my parents at that time couldn't afford the brand that all the kids were wearing. So whether it's a first job, or the fact that they have to earn their pocket money, our children really benefit from life's little lessons. I think it also helps, as parents, that we set an appropriate example ourselves.

Can you explain your 10 step guide to financial freedom?

Jason Cunningham: You bet, a quick summary of the 10 step guide to financial freedom is:

1.Get your head right - before embarking on your journey to financial prosperity, you need to be switched on and understand what it is that you want to achieve with money;

2.Understand your risk profile and protect yourself;

3.Consolidate bad debt - and by bad debt, I mean credit card debt and short-term finance. This is generally quite expensive so the sooner it's out of the way, the better;

4.Create a budget - the cornerstone of any successful financial plan is a budget, where the golden rule is bottom-up budgeting - let profit drive the outcome;

5.Maximise your income earning potential - the majority of Australians earn their income from a job, therefore be the best you can be at work;

6.Buy property - the smart way, as a general rule, if buy the right property in the right area, it should double in value every 10 years (or 15 years as a worst case scenario);

7.Have a crack at the share market - it's important to diversify your investments so that you don't have all your assets in one basket;

8.Business - the ultimate in leverage, remember it's not suited to everyone, however if you have the dedication and the ability, it is the best use of leverage - other people's time;

9.Protect your assets - we have a hard enough time accumulating wealth without having to worry about the threat of someone trying to take it away from us;

10.Get some help from the tax man - generally tax is our biggest expense, so why wouldn't you learn the strategies available to minimise it?

Where's My Money? includes Jason's own personal tips: little, regular, everyday things that he and his family do, and that readers can easily adopt, which over time add up to a significant financial outcome. This 10-step, plain-English guide has something for everyone, whether they earn $35K or $350K. Packed with practical tools and real-life examples, Where's My Money? Will help readers take charge of their financial future. The book is available at all good books stores and online www.wheresmymoney.com.au

* *Jason Cunningham is an accountant, financial planner and co-founder of financial services business The Practice. Jason talks straight and calls it as he sees it. By day, he's a mild-mannered accountant and partner in a successful accounting and advisory firm… but he also happens to be one of only 7 accountants the world over with a sense of humour. There's an element of educated larrikin, raconteur and natural showman in Jason that enables him to relate to and inspire his clients. Above all, he's passionate about helping people achieve their full financial potential. Jason has been recognised by CPA Australia as one of their Premier Trainers, and has presented and facilitated over 100 seminars and workshops for their members. Jason has extensive experience in helping a wide range of clients grow and manage their financial affairs - individual wage-earners, small business owners, executives and CEO's, through to publicly listed companies.

Where's My Money?

Author: Jason Cunningham

ISBN: 9780731408330

Price: $32.95

Available online: www.wheresmymoney.com.au

MORE

Copyright © 2001 - Female.com.au, a Trillion.com Company - All rights reserved. 6-8 East Concourse, Beaumaris, Vic 3193, Australia.